Legislation in the form of a bill called House Bill 821 calls for the amendment of Title 48 of the Official Code of Georgia Annotated, which — if passed — will essentially eliminate the sales and use taxes levied on jet fuel for all airlines which purchase fuel in the state of Georgia; and greater than 800 students arrived at the world headquarters of Delta Air Lines yesterday, Tuesday, February 13, 2018 at 10:30 in the morning to protest.

Did Delta Air Lines Turn a Protest Into an Opportunity?

With the busiest airport in the world as its hub in Atlanta, Delta Air Lines stands to benefit the most from this legislation if it becomes law — and public schools could potentially be amongst the biggest losers as a result.

Currently, airlines are taxed on jet fuel in the forms of sales and use taxes for both the state of Georgia and Clayton County — in which the international airport which serves the greater Atlanta metropolitan area resides — pursuant to the County Special Purpose Local Option Sales Tax, the Sales Tax for Educational Purposes, the Special District Transportation Sales and Use Tax, and the Special District Mass Transportation Sales and Use Tax. If airlines are exempt from paying those taxes, Clayton County is expected to lose a significant amount of revenue.

“Clayton County school officials said it will create a $20 million hole in their budget and deprive students of critical resources”, according to this article written by Aungelique Proctor of WAGA-TV Fox 5 News in Atlanta. “‘The number one thing is renovation because our school is so old. We need things for technology and for buses for kids to explore new things,’ said student Kennedi Russell.”

As sanctioned by officials of Clayton County Public Schools in what they called “experiential learning”, the students skipped school for the day; boarded 18 school buses; and participated in a demonstration at the world headquarters of Delta Air Lines.

Delta Air Lines “seemed to quickly turn the protest into an opportunity”, according to the aforementioned article. “They invited the students inside, gave them a tour of the museum, and even provided lunch before informing students that they will need to hire 25,000 employees over the next five years.”

Georgia currently enjoys revenue of approximately $35 million per year as a result of the jet fuel tax burden on airlines — which is the eighth-highest in the United States. The elimination of the tax means that that revenue disappears while Delta Air Lines simultaneously could save millions of dollars on jet fuel taxes.

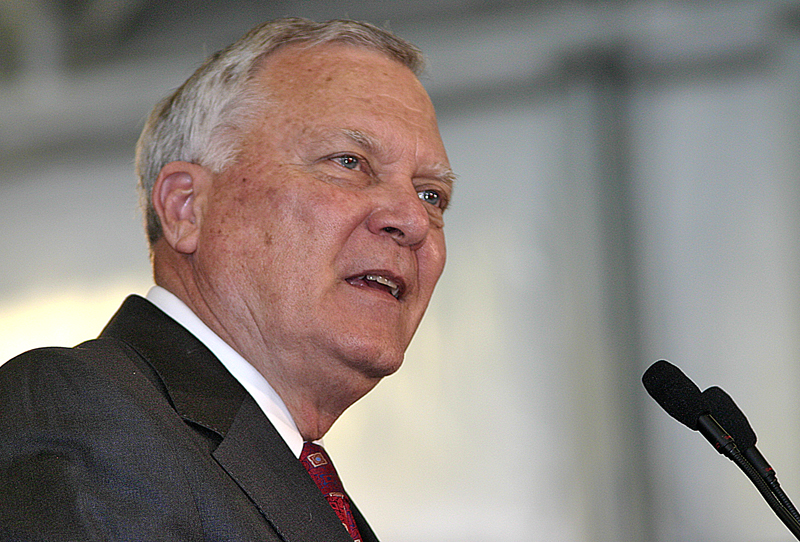

House Bill 821 “will also help our state be more competitive by eliminating the sales tax on jet fuel, which will encourage airlines to fly additional direct flights from Georgia to destinations around the globe. Georgia and our businesses are global competitors, we need direct air travel to provide our companies with immediate access worldwide. By removing the sales tax on jet fuel, we can level the playing field for our airports and airlines to compete”, according to this article from the official Internet web site of Nathan Deal, who is the current governor of Georgia. “The sooner this legislation is passed, the sooner Georgians will be able to file their returns and receive their refunds.”

Apparently, residents, students and school officials in Clayton County beg to differ with that assessment. Forces are “trying to railroad HB 821 through in order to achieve their goal”, said Morcease Beasley — who is the superintendent of Clayton County Public Schools — according to this article written by Heather Middleton of Clayton News-Daily. “He added if the bill passes it would void the county’s petition with the courts” in reference to a lawsuit which Clayton County filed against the Federal Aviation Administration of the United States, which ruled back in December of 2014 that jet fuel tax revenues must be used for airports rather than for other purposes — such as roads or schools, for example.

Trebor Banstetter — who is a spokesman for Delta Air Lines — said that “the company has been in discussions with Clayton schools for more than a year to find a solution to the jet fuel tax issue, adding, ‘we have a mutual interest to ensure that Clayton County schools will not see a funding shortfall as the tax is phased out’”, according to this article written by Ty Tagami of The Atlanta Journal-Constitution. “Delta says that even without the tax the company will remain a financial mainstay for Clayton. Its property accounts for 8 percent of the county’s assessed value, making it the top property taxpayer at $23 million in 2017. The company also employs more than 33,000 Georgians, 5,000 of whom live in Clayton.”

Summary

Was Aungelique Proctor correct when she reported that “Delta Air Lines seemed to quickly turn the protest into an opportunity”, as she said in the video shown above? If so, was this a clever marketing and public relations technique implemented by Delta Air Lines — or was it an unethical attempt at diverting the main issue at hand?

The main campus of the world headquarters of Delta Air Lines in Atlanta. All photographs ©2009 and ©2014 by Brian Cohen.