I f you have stayed at a hotel or motel property within the state of Georgia during the past 13 days, you might have noticed that the room rate is more expensive. This is because effective as of Wednesday, July 1, 2015, a new tax adds five dollars per night for hotel stays as the result of a new law.

This means that a stay of five nights in the state of Georgia will tack on $25.00 to your folio — in addition to the room rate, existing taxes and fees — when you check out of your room.

The hotel tax was a provision added at the last minute to fund the HB 170 Transportation Funding Act of 2015 with a price tag of greater than $900 million, as voted on in the final version of the law by members of the Georgia General Assembly.

Section 5-15 starting on page 18 of this document — now known as Code 48-13-50.3 — states the following:

On or after July 1, 2015, each innkeeper in this state shall charge a $5.00 per night fee to the customer, unless it is an extended stay rental, for each calendar day a room, lodging, or accommodation is rented or leased. The innkeeper shall collect the fee at the time the customer pays for the rental or lease of such room, lodging, or accommodation. The innkeeper collecting the fee shall remit the fee on a monthly basis to the department.

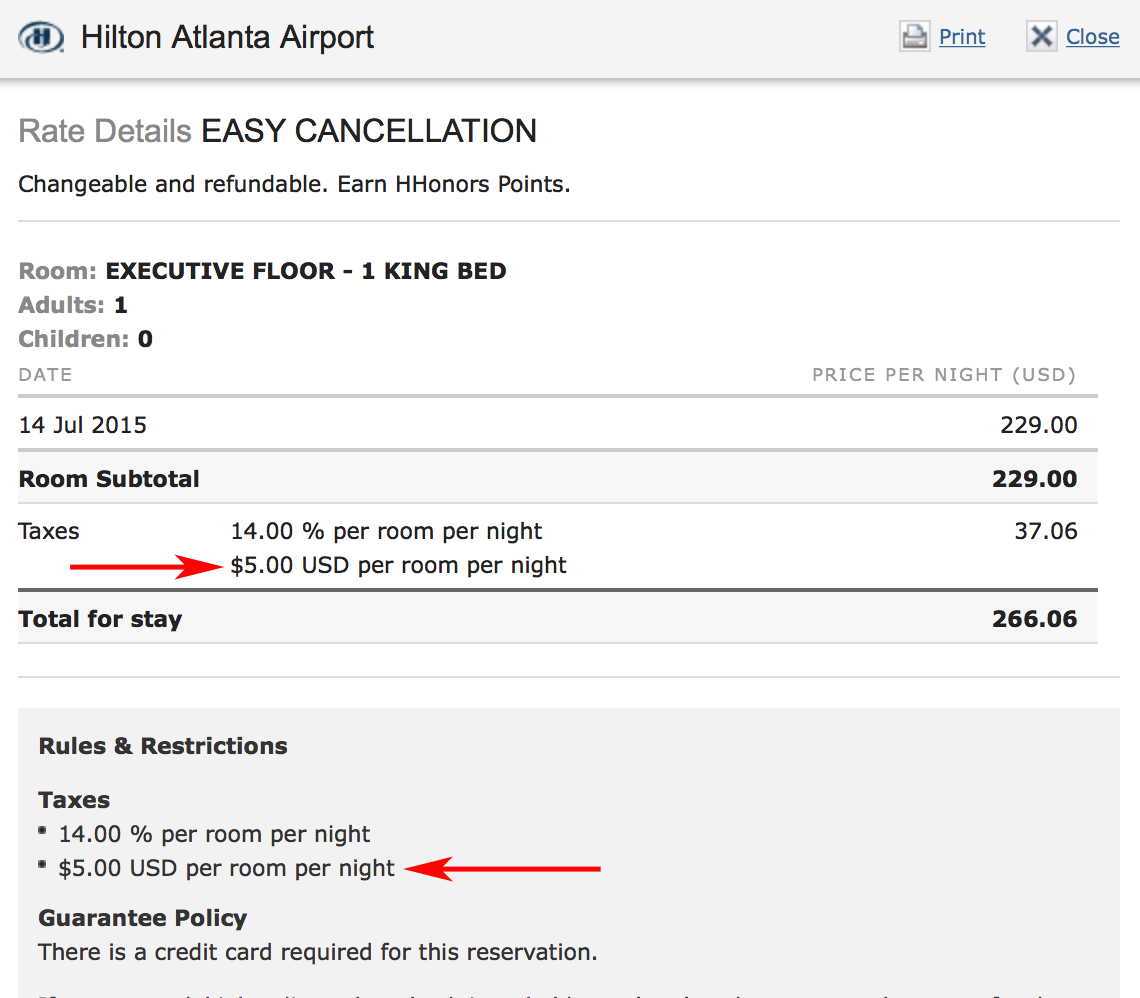

I personally checked for myself by pretending to reserve a room at hotel properties within the state of Georgia — and sure enough, there was the fee of five dollars per night added to the room rate as shown in the graphic at the top of this article. Note that it does not matter whether the room rate is $50.00 per night or $5,000.00 per night — the tax is still an extra five dollars per night.

Opposed to the new tax, representatives of the hospitality industry had already been lobbying to scale back the tax — but with no success at this time. Even dedicated Internet web sites which opposed the bill — such as this one on Facebook — had little to no impact.

Jim Sprouse — who is executive director of the Georgia Hotel and Lodging Association and someone whom I have known professionally for years — said that the new tax penalizes residents of the state of Georgia, who are responsible for more than half of hotel stays in some parts of the state and will have to collectively pay as much as $48 million extra in taxes.

Other people are concerned that the increased revenues anticipated by the new hotel tax may be offset — and perhaps overshadowed — by decreased hotel reservation bookings worth as much as $104 million, according to one research study.

Taxes on fuel sold in the state of Georgia also increased as of Wednesday, July 1, 2015 as a result of this new law — as much as by 26 cents per gallon of gasoline and 29 cents per gallon of diesel fuel. Although this tax is intend to be paid by distributors of fuel, you can bet that the increases will be passed on to the consumer.

The law also eliminated a tax break on the purchase of jet fuel at the international airport in Atlanta, which had benefited Delta Air Lines — one of the largest companies in the state of Georgia — as well as other airlines, according to Section 5-3 starting on page 9 of this document.

What the state of Georgia did is not unusual in a number of jurisdictions around the world in order to fund projects such as transportation and stadium venues — but is the hotel tax of five dollars per night fair to the traveler?

What are your thoughts?

Source of graphic: Hilton Worldwide, Incorporated. Red arrows indicating the five dollar charge per night added by Brian Cohen.