No! Don’t go into debt to travel! Doing so goes against just about everything pertaining to traveling smart financially — but one recent survey cites that greater than one out of three people who live in the United States plan on doing just that: going into debt in order to travel this summer.

No! Don’t Go Into Debt to Travel!

Despite existing ways to actually reduce the financial burden for travel that are available, the statistics are as follows: “A new Bankrate survey found that only about half (53 percent) of Americans are planning a summer vacation in 2024. Of those who plan to travel this summer, more than 1 in 3 (36 percent) are willing to go into debt to pay for it”, according to this article written by Katie Kelton for Bankrate. “On the other hand, another half (47 percent) of Americans plan to skip their summer vacation this year, citing affordability as the main issue (65 percent).”

Debt is simply when a person owes money until it is paid in full. Being in debt could be good if the interest that is paid on it is less than the interest you could earn on the borrowed money. Debt can also be useful to purchase items that few people can pay in full with cash — such as a house or a motor vehicle…

…but other than those two of very few examples, debt costs significantly more than completely paying for something.

According to the aforementioned survey, 43 percent of respondents use credit cards to pay for their travel; and they pay off their credit card statement in full every month to avoid paying interest.

If I had taken the survey, I would be one of those people. I pay my credit cards in full every month.

Many authors of weblogs and of articles in certain publications receive a commission for every sale of a credit card for which a reader successfully applies by using their affiliate links. Nothing is technically wrong with that — other than the potential conflict of interest or potential bias towards a product which pays the writers well…

…but although the claims of earning tens of thousands of points that are valued at hundreds of dollars are indeed true — and the benefits of some credit cards can potentially be outstanding — not enough emphasis seems to be placed on the ramifications of taking advantage of generous bonuses by credit card companies if the discipline of the credit card holders are weak or non-existent.

Carrying a balance on a credit card is not the only way travelers can take on the burden of debt: employing buy now, pay later services; borrowing money from family or friends; and taking out personal loans are some of the other methods with which debt can be accrued.

Debt can also become a hungry monster that grows incessantly if not kept in check and handled correctly, for debt can easily spiral out of control and trap the borrower into being unable to ever pay it off except through such drastic measures as bankruptcy — but even though that is an extreme example, it does happen.

Regardless of the degree of accuracy of the aforementioned survey, credit card debt exceeded $1 trillion in the United States for the first time, according to data which was released by the Center for Microeconomic Data of the Federal Reserve Bank of New York on Tuesday, August 8, 2023 — at a time when interest rates were the highest that they had been in 22 years.

Final Boarding Call

I do not believe in being in debt, if I can help it. Whenever I do have debt, I usually do everything I can to satisfy it as soon as possible so that I can save hundreds of dollars — perhaps even thousands of dollars — on interest. I have never taken a mortgage or car payment to full term — even when I was in college. I have better things to do with the money that I save…

…like travel.

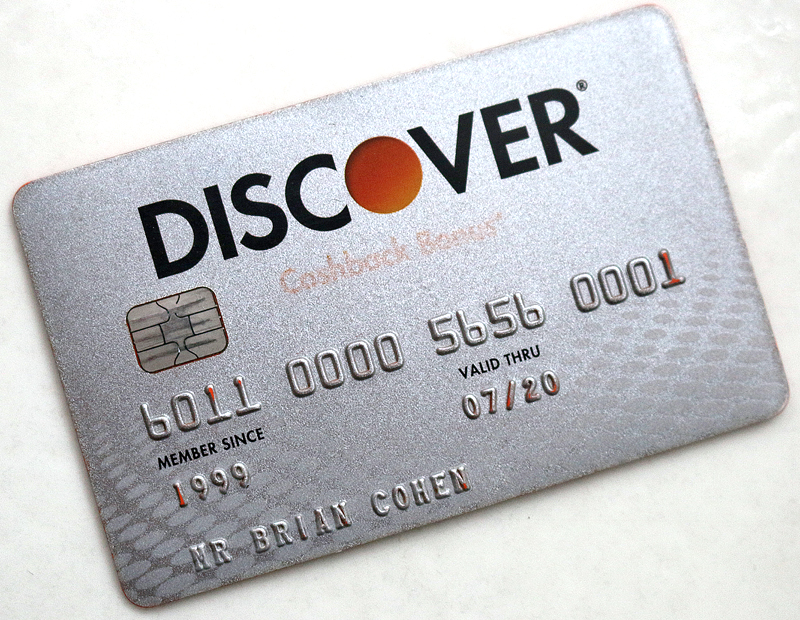

My strategy is simple: if I want a credit card, I wait until a special bonus offer is available before applying for it. I ensure that I get more value out of the credit card than I pay in terms of an annual fee. I also keep at least one card by Visa, Mastercard, American Express, and Discover in my pocket because one never knows what merchants in which countries do not accept certain cards. I check the promotions that the cards offer on a regular basis and take advantage of them when I can — but not if I would not have used the products or services otherwise…

…then, try to take advantage of exceptionally inexpensive airfares, room rates, and rental vehicle rates to get the most value out of each dollar.

As I inferred earlier in this article, sometimes debt is necessary; and sometimes debt is beneficial…

…but to go into debt simply to travel — at least, most of the time — and potentially pay hundreds more dollars than necessary in the form of interest payments just seems ludicrous and financially irresponsible to me, in my opinion; and doing so completely defeats the purpose of taking advantage of the lucrative benefits that are associated with successfully applying for a new credit card.

People are usually better off sacrificing something to save up enough money to do something else. Perhaps go out to eat fewer times per week; pare down on any unnecessary expenses; and save the money to be able to pay to travel without having to incur debt…

All photographs ©2016, ©2019, and ©2023 by Brian Cohen.