Bitcoin is one digital form of currency called cryptocurrency whose value decreased significantly this past week to the lowest level since November of 2020 and has been part of the volatility that has stressed investors of this and other forms of the encrypted decentralized form of digital currency since the declaration of bankruptcy by a cryptocurrency exchange called FTX…

Where People Are Most Stressed About the State of Cryptocurrency Around the World

…but where are the countries and cities around the world and within the United States where people are the most stressed about the state of cryptocurrency located?

To find out the answer to that question, 722,972 geotagged messages from Twitter were retrieved from major cities all over the world, searching specifically for the cashtags and hashtags of the 50 largest cryptocurrencies by market cap — for example, $BTC or #BTC.

Only messages from Twitter which were written in English were allowed; and a maximum of five messages from Twitter from the same account were allowed. All messages from Twitter had to include either a cryptocurrency cashtag or hashtag.

To analyze the level of stress in the messages from Twitter, sentiment analysis tool TensiStrength was used, which places a numerical value on the stress levels of social media posts. The proportion of stressed messages from Twitter for each area and cryptocurrency were then able to be calculated.

The data was retrieved in August 2022.

This article from Coin Kickoff gives more details about the countries and cities around the world and within the United States where people are the most stressed about the state of cryptocurrency; and I have been given express written permission to use the graphs and the verbatim text from the aforementioned article in this article. While Coin Kickoff has endeavored to ensure the information provided is accurate and current, it cannot guarantee it, as this information is general in nature only and does not constitute personal advice. Neither Coin Kickoff nor The Gate accept any liability — and assume no responsibility — for any and all information which is presented in this article.

With that disclaimer out of the way, here is the article.

Where Are People Most Stressed About the State of Cryptocurrency Around the World?

Investing your hard-earned income in a fluctuating market can be a stressful experience at the best of times. Still, the unpredictability and volatility of cryptocurrency are, for many people, on another level.

In contrast to the stock market, which is subject to strict financial regulation, crypto is more decentralized, meaning that anyone can create a currency provided people are willing to invest in it. While Bitcoin has been around since 2009, interest and investment in cryptocurrency have steadily become more mainstream since the mid-2010s, with more competition in the coin market and more merchants accepting crypto as payment.

Global interest and increased competition for currencies have led to increased volatility in the market. Bitcoin, for example, lost more than half of its value between November 2021 and May 2022, and the value of Ethereum — the second largest currency, dropped below $900 in June 2022 after record highs late in 2021.

With real-world events and benevolent billionaires causing currency values to fluctuate, it’s no wonder that investors around the world find their cryptocurrency stock stressful to hold. The market is rapidly changing, and it is unwise to invest in currencies without understanding how they work. That’s why Coin Kickoff wanted to find out where in the world people are most stressed about the state of crypto.

What We Did

To find out where in the world cryptocurrency investment stresses people out the most, we analyzed geotagged tweets for the hashtags of the 50 most popular cryptocurrencies by market cap.

We then analyzed posts using TensiStrength, a sentiment-tracking algorithm that places a value on stress levels within tweets so that we can see the proportion of stressed tweets for the world’s major cities, countries, and cryptocurrency assets.

Key Findings

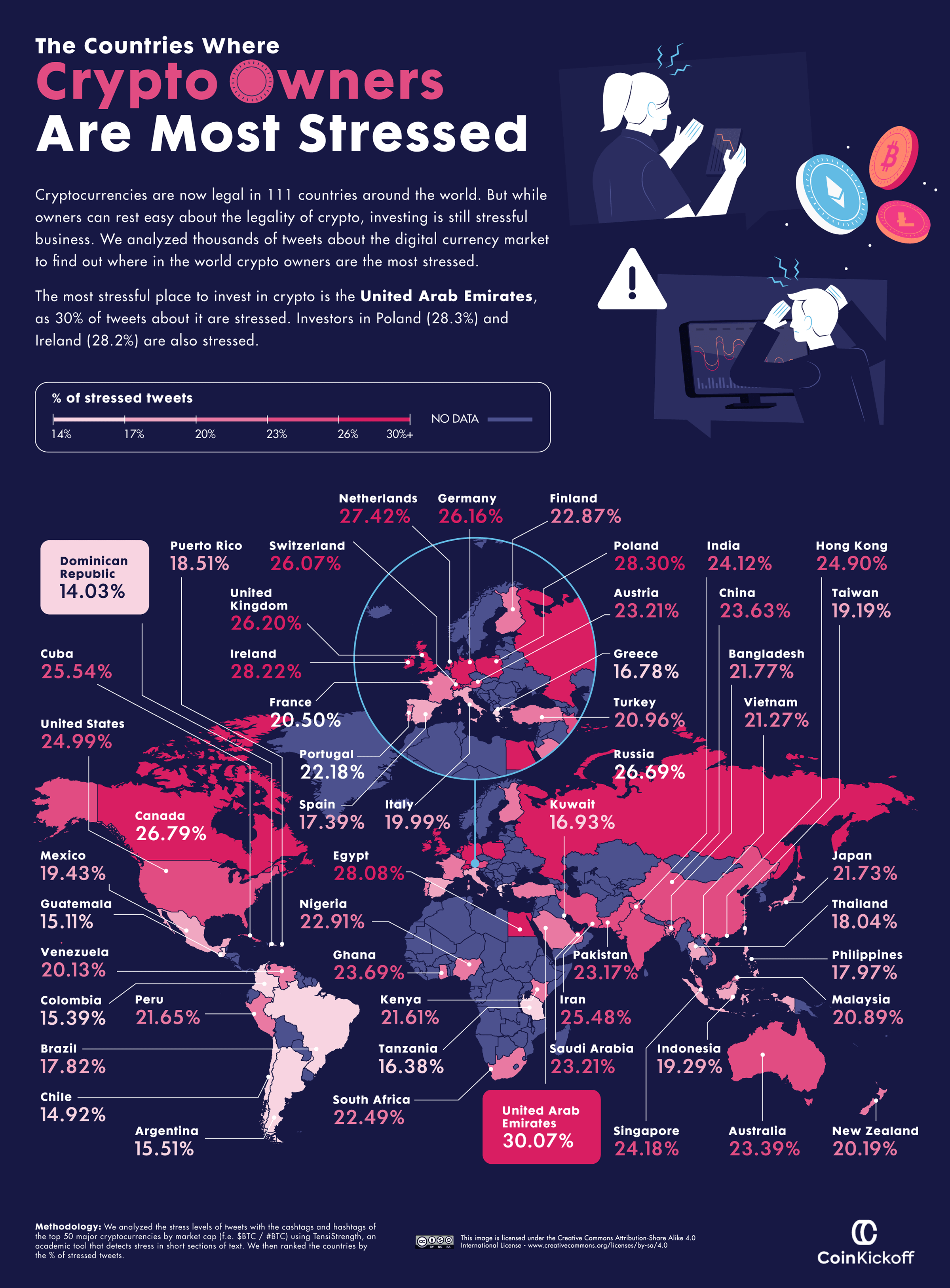

- The United Arab Emirates is the most stressful country to invest, as 30% of tweets about crypto contain stressed sentiment. Investors in Poland (28.3%) and Ireland (28.2%) are also stressed.

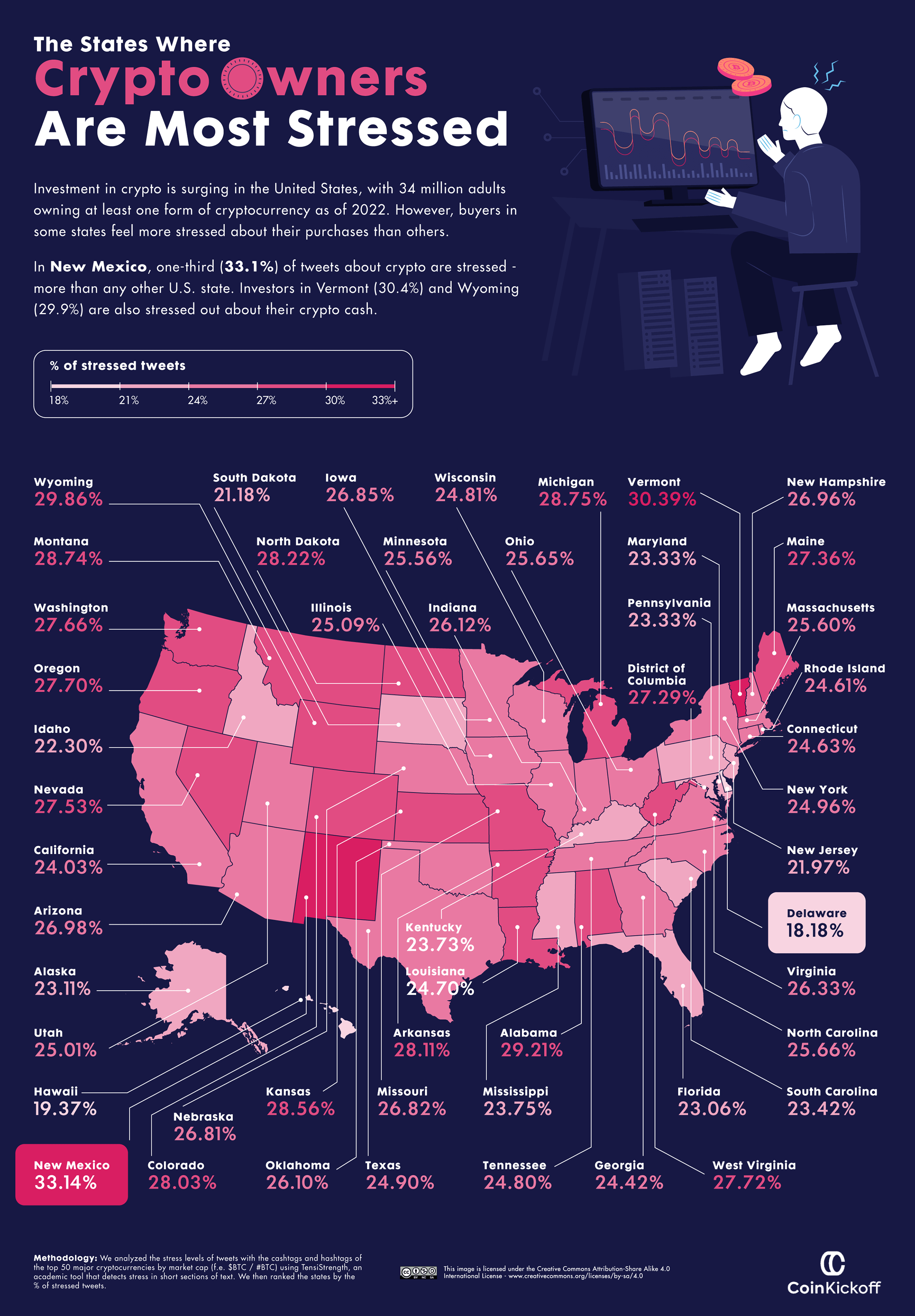

- Investors in New Mexico (33.1%), Vermont (30.4%), and Wyoming (29.9%) are among the most stressed in the U.S. about their crypto cash.

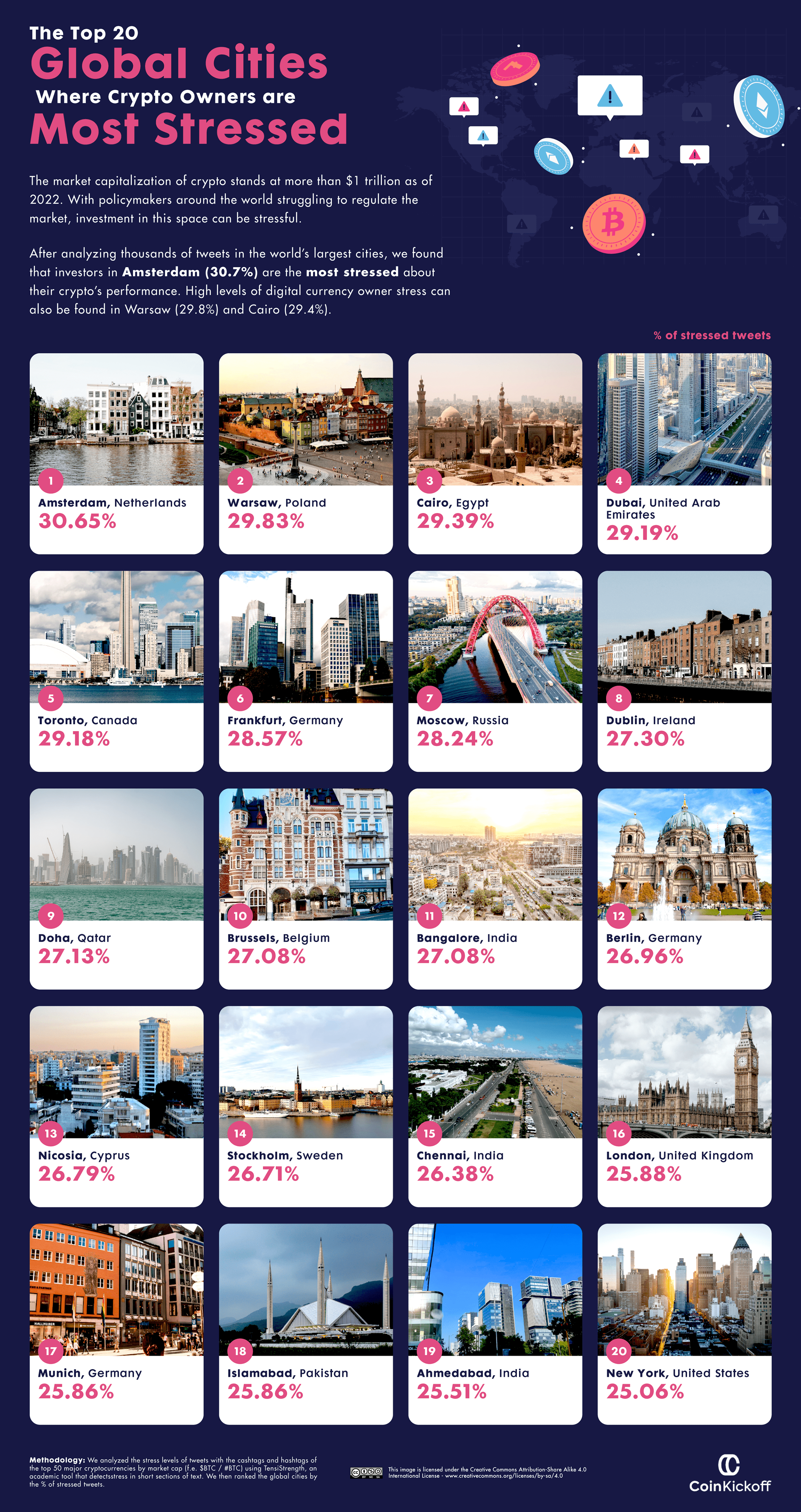

- Investors in Amsterdam (30.7%) are the most stressed about their crypto’s performance. High levels of digital currency owner stress can also be found in Warsaw (29.8%) and Cairo (29.4%).

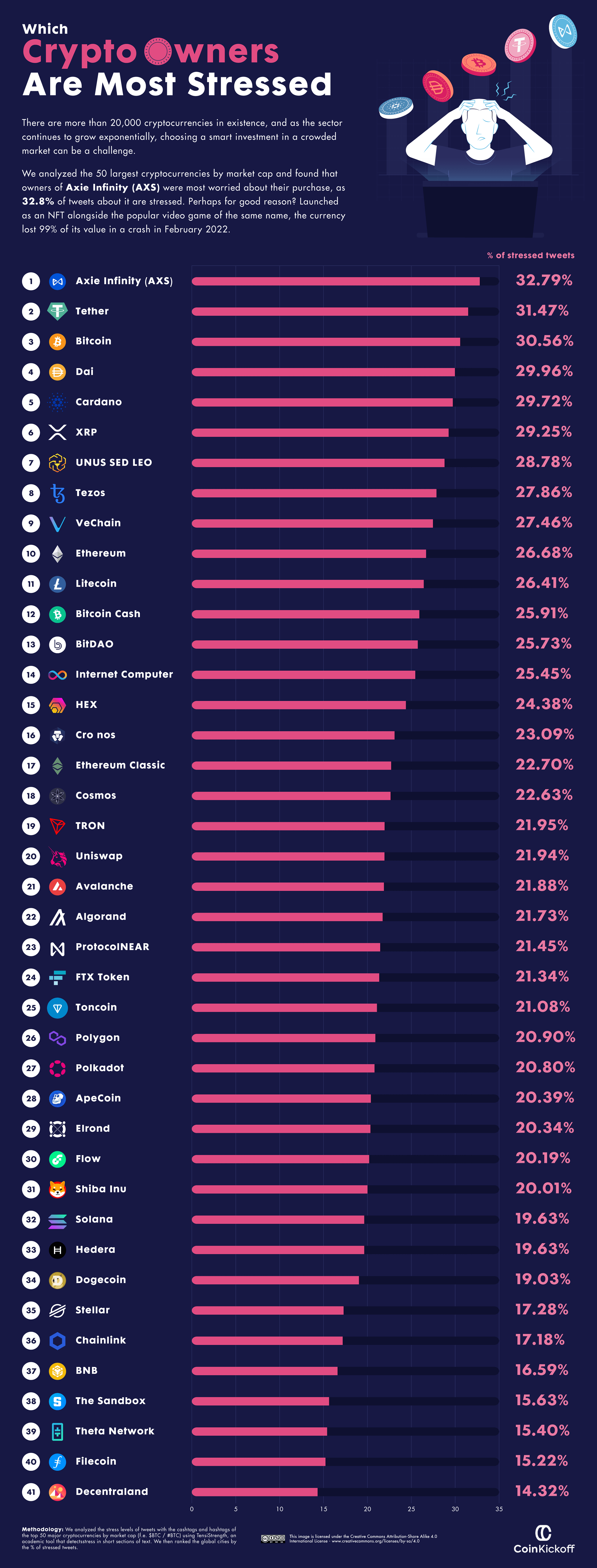

- Owners of Axie Infinity (AXS) were most worried about their purchase of any cryptocurrency. 32.8% of tweets about it contained stressed sentiment. The currency lost 99% of its value in a crash in February 2022.

Crypto Stresses Out People of United Arab Emirates Most, Despite Dubai’s Global Tech Aspirations

Global interest in crypto-assets has soared in the last year, fuelled by the surge in Bitcoin prices. A Chainanalysis study found that worldwide adoption of crypto jumped by 880% in 2021, with Vietnam and India leading the take-up. While nine countries — including China and Bangladesh, have banned virtual currencies, it’s clear that the market is becoming increasingly global in stature.

Our analysis found that of the 131 countries where cryptocurrency can be bought and sold, residents of the United Arab Emirates are the most anxious about their investment. 30% of tweets about crypto contain stressed sentiment, more than investors in Poland (28.3%) and Ireland (28.2%).

Dubai currently hosts Asia’s largest event for virtual currency investors, with ambitions of being a global tech hub and the first to run their economy using blockchain, using Emirati-owned coin EmCash as the mechanism. Despite this, there are concerns that the UAE’s proactive approach contrasts with the cautious regulatory strategies of the West, with uncertainty over the impact this will have on global markets.

Volatility of Crypto Market Concerns New Mexico Residents More Than Other U.S. States

Meanwhile in the United States, federal authorities are grappling with an unstable market and the industry’s environmental impact. A White House policy report found that crypto mining could hinder America’s ability to combat climate change, with operations using more energy than home computers or residential lighting.

In response to this and to 2021’s price surge, which saw the market cap reach $3 trillion, President Joe Biden passed an executive order in March 2022 to regulate the crypto industry and protect investors, consumers, and businesses.

The boom-and-bust nature of crypto trading makes it a stressful experience for Americans, and of the 50 states, investors in New Mexico are the most anxious about their portfolio. Around a third (33.1%) of tweets show high levels of stress, more than Vermont (30.4%) and Wyoming (29.9%). The Cactus State has the 4th-lowest median income, with investors more susceptible to losing out from sudden price shocks in the crypto market.

Amsterdam is the World’s Most-Stressed City About Cryptocurrency

Traditionally, the stock market economy has concentrated its wealth in the major financial cities of New York, London, Frankfurt, Shanghai, and Tokyo. Sixteen major exchanges have a market capitalization larger than $1 trillion and comprise around 87% of the world’s equities value.

By contrast, the crypto market is far more diverse. Analysis shows that transactions are far more spread out across the world, with emerging markets like Vietnam and Nigeria leading the way for crypto investments. Major cities are catching up with trends and introducing new infrastructure to make them more crypto-friendly with Bitcoin ATMs and retailers who accept alternative payments.

However, investing in crypto can still be stressful business in the world’s major cities. Despite its reputation as one of the world’s most crypto-friendly towns, investors in Amsterdam are the most anxious, with 30.7% of tweets about virtual currencies containing stressed sentiment.

The canal city is home to Europe’s largest blockchain expo, the Bitcoin Embassy, and the European headquarters of BitPay, the industry’s largest payments processor. Meanwhile, residents of Warsaw (29.8%) and Cairo (29.4%), where the Egyptian government banned crypto, are also feeling the heat.

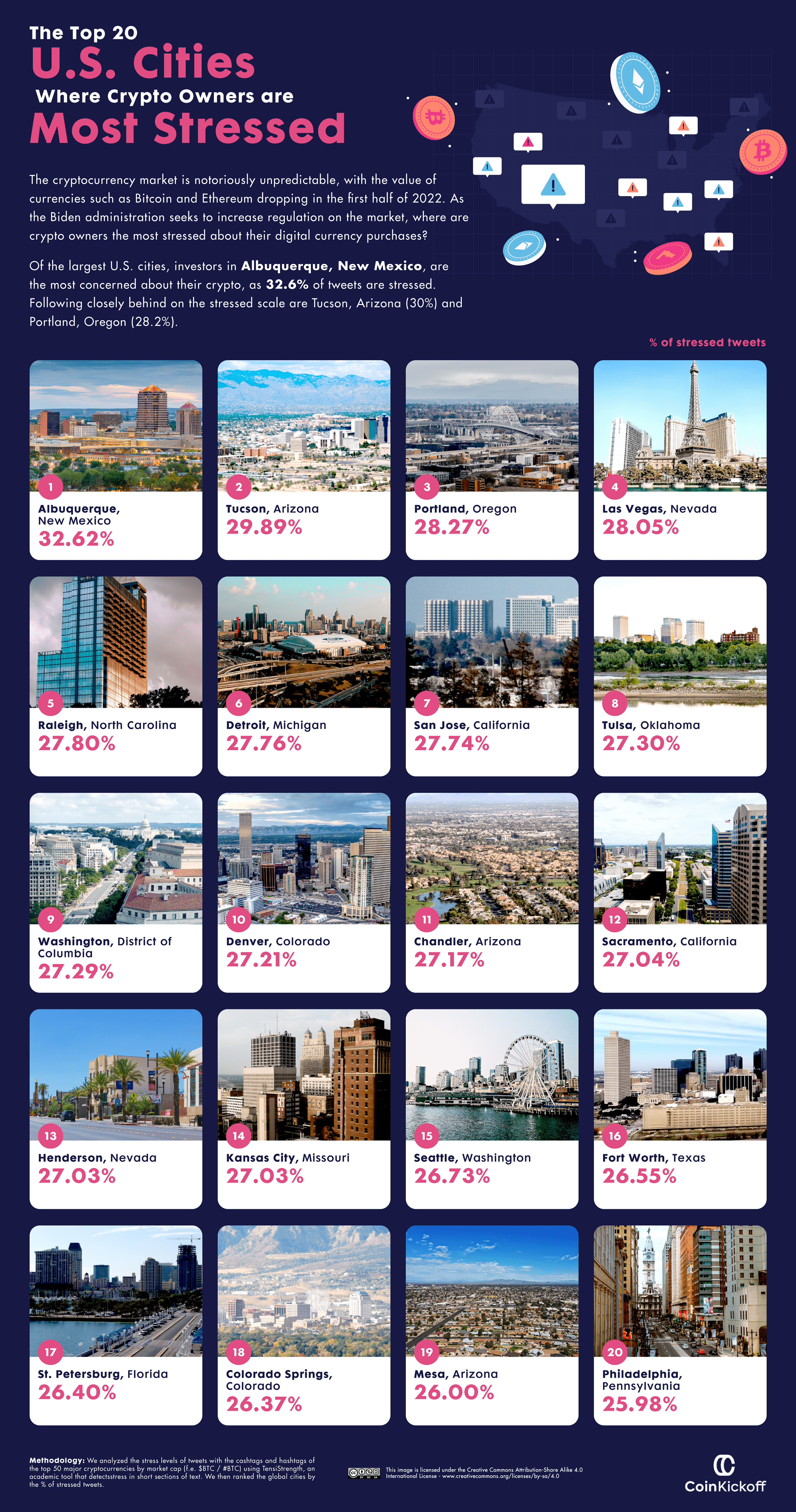

Albuquerque Residents Feeling the Heat Over Their Crypto Stock

A Pew Research Center survey suggests that 16% of Americans have invested in, traded, or used cryptocurrency, with take-up rising to above 30% among the under-30s. It is estimated that 33.7 million people across the U.S. will own some form of crypto by the end of 2022 – almost 13% of the population.

With the popularity of Bitcoin and other currencies on the rise, residents of America’s towns and cities will be keeping a closer eye on how the market performs. Our study found that residents of Albuquerque, New Mexico, are the most stressed-out, with 32.6% of anxious tweets about crypto in the city – higher than those in Tucson, Arizona (30%) and Portland, Oregon (28.2%)

America’s 32nd-most populous city is home to Devvio, a blockchain startup that claims to use 3.5 billion times less energy than Bitcoin on a single transaction, at a time where increased regulation and pressure on the environment mandates sustainable solutions to crypto’s energy consumption problem.

Axie Infinity (#AXS) Stresses Out Owners After Losing 99% of Its Value

As a result of crypto’s exploding popularity, thousands of new coins have entered the market aiming to attract investors and surges in value as buyers seek to cash in on the ‘next Bitcoin.’ The frenzy has also led to a host of ‘meme stocks,’ which gain rapid popularity through social media hype. Though initially set up as a ‘joke,’ Dogecoin has become one of the 10 largest cryptocurrencies by market cap, despite Elon Musk’s frequent tweets significantly influencing its value.

However, not every crypto can withstand the volatility of the market. With more than 19,000 different coins in existence, it’s extremely likely that thousands will fail after their initial offering, with experts comparing it to the ‘dot-com bubble’ of the 1990s. The crash of Ethereum following the ‘Bored Ape’ NFT craze of 2022 is a cautionary tale for investors bandwagoning on the back of pop-culture trends.

Of the 50 largest cryptocurrencies by market cap, our analysis shows that investors of Axie Infinity (#AXS) are the most anxious about their purchase, with 32.8% of tweets about it containing stressed sentiment — more than those about Tether(31.5%) and Bitcoin (30.6%).

Based on a popular video game by Vietnamese studio Sky Mavis, the Axie Infinity coin is an Ethereum-based cryptocurrency that fuels the game’s economy. However, hackers stole $615 million from its Ronin Network in March 2022, causing a 99% drop in value amid a wider drop in crypto prices at the time.

How To Keep Your Cool in the Boom-and-Bust Crypto Market

There is no doubt about it – the volatility of the cryptocurrency market and the lack of resilience in prices make investing a stressful business. Global policymakers continue to introduce cryptocurrency legislation to protect customers and mitigate the impact of fluctuations on global markets.

As investors wait for the next ‘crypto-bubble’ to cash in on, it’s natural that the uncertainty over coin values will make owners anxious. You can view our full dataset below to see how much crypto stressed out people in your city or country, as well as the stress levels of the 50 most valuable currencies on the market.

The world is catching up to the popularity of a free-spirited form of anarcho-capitalism with deep ideological roots – which clash with attempts to regulate it. The popularity of crypto around the world suggests that it has become a global phenomenon, with global cities harnessing the power of blockchain to shape the future of their economies.

As with any investment, it is important to research the market thoroughly and understand exactly what you’re investing in before making a commitment. Coin Kickoff’s guides on popular and emerging coins on the market are a great place to start. While many investors trade cryptocurrency in real-time using platforms like Coinbase or Binance, it is also worth considering investing in crypto through a specialist fintech broker such as SoFi or eToro. Whether you’re a first-time coin purchaser or a veteran crypto trader, monitor the markets closely and invest responsibly.

Final Boarding Call

Cryptocurrency is a digital currency which is an alternative form of payment created using encryption algorithms and functions both as a currency and as a virtual accounting system due to the use of encryption technologies. A cryptocurrency wallet is needed to use cryptocurrencies; and the wallet can be software that is a “cloud-based” service or is stored on your computer or on your mobile electronic device. The wallets are the tool through which you store your encryption keys that confirm your identity and link to your cryptocurrency, which has been rather volatile recently.

As a disclosure, I do not own any amount of cryptocurrency — but if you do, I hope you are not stressed…

Photograph ©2015 by Brian Cohen.