A definitive merger agreement between JetBlue Airways Corporation and Spirit Airlines, Incorporated — which are the respective parent companies of JetBlue Airways and Spirit Airlines — was announced on Thursday, July 28, 2022 shortly after the board of directors at Spirit Airlines voted on terminating its merger with Frontier Airlines effective as of Wednesday, July 27, 2022; and it will result in the creation of the fifth largest airline in the United States once the merger is completed.

JetBlue Airways to Acquire Spirit Airlines For $33.50 Per Share In Cash

The terms of the merger agreement has been unanimously approved by the boards of directors of both companies, according to both this official press release from JetBlue Airways and this official press release from Spirit Airlines; and they are as follows: “JetBlue will acquire Spirit for $33.50 per share in cash, including a prepayment of $2.50 per share in cash payable upon Spirit stockholders’ approval of the transaction and a ticking fee of $0.10 per month starting in January 2023 through closing, for an aggregate fully diluted equity value of $3.8 billion and an adjusted enterprise value of $7.6 billion.”

The Department of Justice of the United States — along with attorneys general in Arizona, California, Florida, Massachusetts, Pennsylvania, Virginia, and the District of Columbia — filed a lawsuit in the District of Massachusetts on Tuesday, September 21, 2021 to block an unprecedented series of agreements between American Airlines and JetBlue Airways through which the two airlines will consolidate their operations in Boston and New York into what has been called the Northeast Alliance. JetBlue Airways has committed upfront to divest the holdings and assets of Spirit Airlines at airports which are affected by the Northeast Alliance with American Airlines to allow for allocation to other ultra-low-cost carriers. The Northeast Alliance with American Airlines is accelerating growth of low-fare service of JetBlue Airways in the northeastern United States where Delta Air Lines and United Airlines previously had limited competition; and where JetBlue Airways was purportedly locked out of future growth in slot-constrained and congested airports.

In the unlikely event the proposed agreement is not consummated for antitrust reasons, JetBlue Airways will pay:

- Spirit Airlines a reverse break-up fee of $70 million; and

- Stockholders of Spirit Airlines a reverse break-up fee of $400 million — less any amounts paid to stockholders of Spirit Airlines prior to termination

As an argument for potential regulatory approval of this deal by the Department of Justice of the United States — even as the fifth-largest carrier in the United States — the combined airline would have only nine percent of the market share when compared to 13 percent for the fourth-largest airline and 23 percent for the largest carrier. After the combination of JetBlue Airways and Spirit Airlines is complete — and with its committed upfront divestitures — the largest seat share of a combined airline will have in any of its largest metro areas is 40 percent, compared to the 57 percent to as much as 91 percent share which legacy carriers have in their largest metropolitan areas.

The four largest commercial carriers in the United States control greater than 80 percent of the market. The creation of “a low-fare, customer-centric challenger with size and scale is the best opportunity to disrupt legacy carrier pricing in the current landscape”, according to the aforementioned press releases.

The two airlines will continue to operated independently until the deal closes, as according to the aforementioned press releases:

- With its unique combination of everyday low fares and award-winning service, JetBlue Airways claims to have the best track record of disrupting legacy airlines. This has been at the heart of its approach since it first launched in 2000 with all-economy-class service, as it grew its much-loved brand on the East Coast and the Caribbean and Latin America regions, with its fresh take on transcontinental travel and premium experience with Mint, and most recently in transatlantic travel as it added flights to London.

- The acquisition of Spirit Airlines by JetBlue Airways will supposedly give travelers in the United States “the best of both worlds with a hefty boost in competition and choices” as JetBlue Airways accelerates its expansion and ultra-low-fare carriers continue to expand rapidly in number and routes.

Purported Benefits of the Combined Airline Entity

The purported benefits of the combined airline entity include:

- Consumers win With More Choices to More Places, as the combined airline is expected to:

- Offer its combined 77 million customers more options and choices.

- Bring the JetBlue Experience to all aircraft, offering unique combination of low fares and award-winning service of JetBlue Airways to more customers.

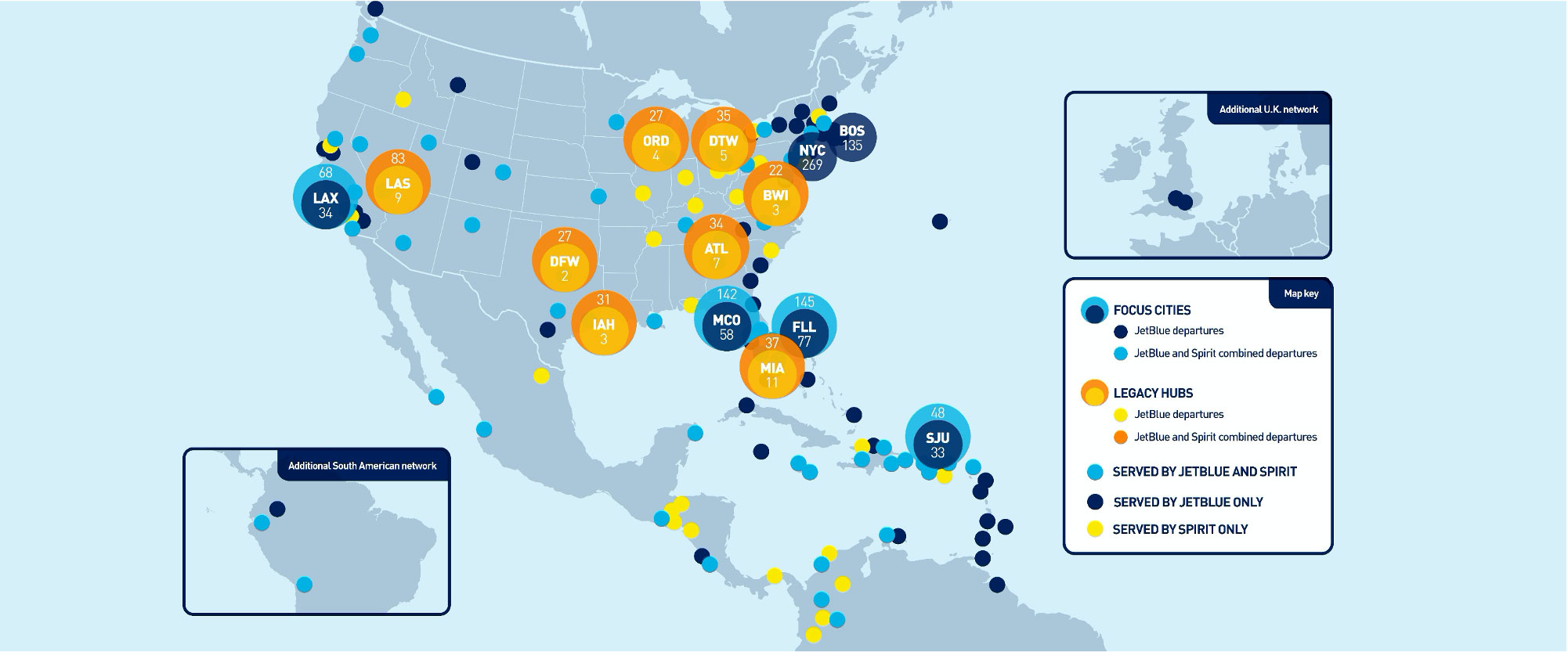

- Accelerate organic growth plan of JetBlue Airways with greater than 1,700 daily flights to greater than 125 destinations in 30 countries, based on December 2022 schedules.

- Increase relevance for JetBlue Airways in certain key focus cities — such as Fort Lauderdale, Orlando, San Juan, and Los Angeles — as well as Big Four airline hubs, which include Las Vegas, Dallas, Houston, Chicago, Detroit, Atlanta, and Miami.

- Have a fleet of 458 aircraft on a pro forma basis; and an order book of greater than 300 Airbus aircraft with fuel-efficient, lower-carbon new engine option engines, providing increased flexibility and efficiency while mitigating the risk of limited availability of aircraft.

- Team members win with expanded opportunities and increased stability, as the combined airline entity expects to:

- Provide more career growth options, broader travel benefits, more opportunities to make a difference in the communities JetBlue Airways and Spirit Airlines serve, and a deeper bench of intellectual capital to support the future growth of the airline.

- Further job growth — including planned insourcing of the outsourced operations of Spirit Airlines in cities where JetBlue Airways has its own crewmembers — of the mission-driven, customer-centric airline of greater than 34,000 crewmembers.

- Expand its no furlough commitment to the team members of Spirit Airlines as they are welcomed into JetBlue Airways after closing.

- Ensure a smooth transition for corporate team members of Spirit Airlines by retaining a support center in Fort Lauderdale, in addition to the other support centers of JetBlue Airways.

- Be committed to working with labor leaders at both airlines and JetBlue Airways values committee representatives to ensure the combination supports the needs of those that operate the airline.

- The reach of sustainability leadership is expected to be expanded:

- The all-Airbus combined fleet would include new A220s and A320neos, which are proven to deliver double-digit improvements in fuel and carbon emissions. After closing, JetBlue Airways will leverage the order book for the combined company to accelerate the fleet transition to next generation, fuel-efficient aircraft.

- JetBlue Airways expects to extend its industry-leading climate commitments to the combined airline — including its target to achieve net zero carbon emissions by 2040, which is ten years ahead of the broader goal of the airline industry in the United States.

- JetBlue Airways would extend its goal to convert ten percent of jet fuel to sustainable aviation fuel by 2030 to the combined airline, with plans to introduce regular use of sustainable aviation fuel into the West Coast operations of Spirit Airlines after closing.

- Shareholders win with superior value creation, as the combination of JetBlue Airways and Spirit Airlines is expected to deliver enhanced value to shareholders of both companies as follows:

- JetBlue Airways will acquire Spirit Airlines for $33.50 to up to $34.15 per share in cash, depending on the timing of closing, including

- An accelerated prepayment of $2.50 per share in cash, payable promptly after the stockholders of Spirit Airlines approve the transaction, and

- A ticking fee prepayment of $0.10 per share per month between January 2023 and the consummation or termination of the transaction.

- In the event the transaction is consummated on or before December 2023, the transaction consideration will be $33.50 per share, increasing over time to up to $34.15 per share, in the event the transaction is consummated at the outside date in July 2024.

- The transaction consideration of $33.50 per share implies an aggregate fully diluted equity value of approximately $3.8 billion — based on total consideration of $33.50 per share of Spirit Airlines, assuming closing in December 2023; and approximately 112.4 million fully diluted shares outstanding, per the merger agreement — and an adjusted enterprise value of $7.6 billion, which Includes adjusted net debt of $3.8 billion including operating leases of $2.0 billion as of March 31, 2022, based on the 10-Q of Spirit Airlines in the first quarter of 2022.

- JetBlue Airways expects to achieve up to $700 million in net annual synergies once integration is complete, driven in large part by expanded customer offerings resulting from the greater breadth and depth of the combined network.

- The combined company is projected to have annual revenues of approximately $11.9 billion based on 2019 revenues. JetBlue Airways expects the transaction to be significantly accretive to earnings per share in the first full year following closing.

- JetBlue Airways expects to maintain balance sheet flexibility with post-transaction leverage of up to 3.5x — well within historical levels — and to continue its deleveraging trajectory as it captures synergies.

- JetBlue Airways will acquire Spirit Airlines for $33.50 to up to $34.15 per share in cash, depending on the timing of closing, including

As a combined airline entity, JetBlue Airways and Spirit Airlines expect to change the commercial aviation industry for the benefit of consumers by bringing more ultra-low fares to more travelers in more destinations across the United States, Latin America, and the Caribbean — including major cities as well as underserved communities. The stronger financial profile of the combined company will empower it to accelerate investment in innovation and growth and compete even more aggressively — especially against American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines — among others.

Final Boarding Call

Press releases and official announcements from companies which are involved in a merger or acquisition are filled with positive “forward-looking statements” and almost never discuss the disadvantages of what they are doing, as all that really matters is profitability and anything associated with that.

Some route overlaps do occur between JetBlue Airways and Spirit Airlines. Will those overlaps mean more frequencies in schedules — or an opportunity to cut costs by consolidating or eliminating some of the supposedly duplicitous flights?

Less competition usually means higher costs for customers. Will the combined entity of JetBlue Airways and Spirit Airlines — which has yet to be officially named at the time this article was written — be an exception?

Also, what will the frequent flier loyalty program ultimately look like with the combined airline? A frequent flier loyalty program is a tool which is used by an airline to market to — and, ultimately, successfully sway — a potentially profitable customer to give his or her business to that airline instead of its competitors. Will there be less of an incentive for the frequent flier loyalty program of the combined airline to offer enticing benefits?

Time will tell, as the answers to all of these questions and more will be forthcoming as the merger between the two airlines progresses — but it still faces regulatory approval from the federal government of the United States, which is not expected to come easily…

All photographs ©2013, ©2015, and ©2018 by Brian Cohen.